In the ever-evolving landscape of wealth management, the ability to adapt to global regulations is paramount for ultra high net worth individuals. This article delves into the intricate world of regulatory compliance, exploring how the elite navigate the complex web of rules and standards governing their wealth.

As we unravel the strategies and technologies that facilitate compliance, a deeper understanding emerges of the challenges and opportunities that come with managing vast fortunes in a global context.

Understanding Global Regulations in Wealth Management

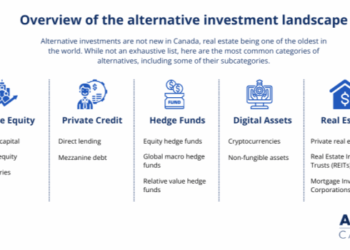

Global regulations play a crucial role in shaping the landscape of wealth management, particularly for ultra high net worth individuals. These regulations impact various aspects of wealth management practices, from compliance requirements to investment strategies.

Global regulations play a crucial role in shaping the landscape of wealth management, particularly for ultra high net worth individuals. These regulations impact various aspects of wealth management practices, from compliance requirements to investment strategies.Impact of Global Regulations on Ultra High Net Worth Wealth Management

- Increased Compliance Burden: Ultra high net worth individuals and their wealth managers are required to adhere to a complex web of global regulations, which often involve stringent reporting and disclosure requirements.

- Risk Management: Global regulations aim to enhance transparency and mitigate risks in wealth management activities, ensuring that UHNW individuals' assets are safeguarded.

- Cross-Border Transactions: Regulations governing cross-border transactions impact how UHNW individuals diversify their assets internationally and navigate tax implications.

Key International Regulatory Bodies Influencing Wealth Management

- Financial Action Task Force (FATF): Sets international standards to combat money laundering and terrorist financing, impacting how UHNW individuals verify the sources of their wealth.

- International Organization of Securities Commissions (IOSCO): Establishes principles for securities regulation globally, influencing investment practices and market integrity for UHNW individuals.

- Basel Committee on Banking Supervision: Develops regulatory standards for banking institutions, affecting how UHNW individuals engage in banking and lending activities.

Compliance with Global Regulations and Wealth Management Strategies

- Due Diligence: UHNW individuals must conduct thorough due diligence on their investments and business dealings to ensure compliance with global regulations and avoid legal risks.

- Tax Planning: Compliance with international tax laws and regulations is crucial for UHNW individuals to optimize their tax planning strategies and minimize tax liabilities.

- Advisory Services: Wealth managers play a pivotal role in helping UHNW individuals navigate the complex regulatory landscape, providing tailored advice to align with global regulations.

Compliance Strategies for Ultra High Net Worth Wealth Management

Ensuring compliance with global regulations is crucial for ultra high net worth wealth management firms to maintain trust and credibility with their clients. By adhering to best practices, these firms can navigate the complex regulatory landscape effectively.

Comparing Regulatory Requirements Across Regions

When operating in multiple regions, wealth management firms catering to ultra high net worth individuals must carefully analyze and compare the regulatory requirements in each jurisdiction. This involves understanding the differences in rules, reporting standards, and compliance procedures to ensure consistent adherence.

- For example, the European Union's Markets in Financial Instruments Directive (MiFID II) imposes strict reporting and transparency requirements on financial institutions, impacting how wealth managers interact with clients and execute trades.

- In contrast, the regulations in Asia-Pacific may focus more on anti-money laundering (AML) measures and client due diligence to combat financial crimes effectively.

- Understanding these regional variations is essential for wealth management firms to tailor their compliance strategies accordingly.

Implementing Successful Compliance Strategies

Wealth management firms serving ultra high net worth clients can adopt various successful compliance strategies to meet regulatory obligations and mitigate risks effectively.

- Establishing a robust compliance framework that includes regular audits, risk assessments, and internal controls to ensure ongoing adherence to regulations.

- Investing in technology solutions such as data analytics and monitoring tools to enhance regulatory compliance and detect any suspicious activities promptly.

- Providing extensive training to staff members on compliance procedures, ethical standards, and regulatory updates to maintain a culture of compliance within the organization.

- Engaging with regulatory authorities and industry experts to stay informed about evolving regulations and best practices in wealth management compliance.

Technology Solutions for Adapting to Global Regulations

In the realm of ultra high net worth wealth management, technology plays a pivotal role in navigating the intricate web of global regulations. From streamlining compliance processes to enhancing data security, technology solutions are essential for ensuring regulatory adherence in a rapidly evolving landscape.Role of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are revolutionizing compliance processes for ultra high net worth clients. These technologies enable the automation of routine tasks, such as data analysis and risk assessments, allowing wealth managers to focus on strategic decision-making and client relationshipsAdvantages and Challenges of Implementing Technology Solutions

Implementing technology solutions in adapting to evolving regulatory landscapes offers numerous advantages. These include increased efficiency, reduced operational costs, enhanced accuracy in reporting, and improved client data protection. Furthermore, technology facilitates better risk management and regulatory compliance, ensuring that wealth managers stay ahead of the curve in a constantly changing regulatory environment.However, along with these benefits come challenges. One major hurdle is the initial investment required for implementing technology solutions, including training staff and integrating new systems. Moreover, ensuring the security and privacy of client data in compliance with regulations like GDPR poses a significant challenge for wealth management firms. Despite these obstacles, the benefits of technology far outweigh the challenges, making it an indispensable tool for adapting to global regulations in wealth management.Risk Management in the Context of Global Regulations

Risk management practices play a crucial role in the wealth management industry, especially when it comes to adhering to global regulations. By tailoring risk management strategies to meet the requirements set forth by regulatory bodies, firms can ensure compliance and mitigate potential risks associated with non-compliance. A robust risk management framework is essential for ultra high net worth wealth management firms to operate within the boundaries of global regulatory standards.Identifying and Mitigating Risks in Compliance

- Conducting regular risk assessments to identify potential areas of non-compliance.

- Implementing strong internal controls and monitoring mechanisms to mitigate risks.

- Training employees on compliance requirements and best practices to minimize errors.

- Utilizing technology solutions for real-time monitoring and reporting of compliance issues.

- Establishing clear communication channels for reporting and addressing compliance concerns.

Importance of a Robust Risk Management Framework

- Enhances transparency and accountability within the organization.

- Helps in building trust with clients and stakeholders by demonstrating commitment to regulatory compliance.

- Reduces the likelihood of fines, penalties, and reputational damage due to non-compliance.

- Ensures long-term sustainability and growth by adhering to global regulatory standards.

- Provides a competitive advantage by showcasing a strong risk management culture.

Last Word

As we conclude our exploration of how ultra high net worth wealth management adapts to global regulations, it becomes evident that staying ahead in this realm requires a delicate balance of innovation and adherence to regulatory frameworks. Navigating these waters successfully not only safeguards wealth but also paves the way for sustainable growth and prosperity in an increasingly interconnected world.

FAQ Guide

How do global regulations impact ultra high net worth wealth management?

Global regulations shape the strategies and practices of managing vast wealth for ultra high net worth individuals by setting standards and guidelines that must be followed to ensure compliance.

What are the best practices for compliance with global regulations in wealth management?

Best practices include thorough due diligence, regular audits, and staying informed about regulatory changes to adapt strategies accordingly.

How does technology aid in adapting to global regulations in wealth management?

Technology assists in streamlining compliance processes, enhancing efficiency, and enabling firms to stay abreast of regulatory requirements through automated solutions.

What role does risk management play in the context of global regulations for ultra high net worth individuals?

Risk management is crucial in identifying and mitigating non-compliance risks, ensuring adherence to regulatory standards, and safeguarding wealth from potential legal and financial consequences.