Beginning with how Ultra High Net Worth Wealth Management Minimizes Tax Exposure Worldwide, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Exploring the intricacies of managing wealth for Ultra High Net Worth individuals and the strategies employed to minimize tax exposure globally sets the stage for a riveting discussion on financial optimization.

The Importance of Ultra High Net Worth Wealth Management

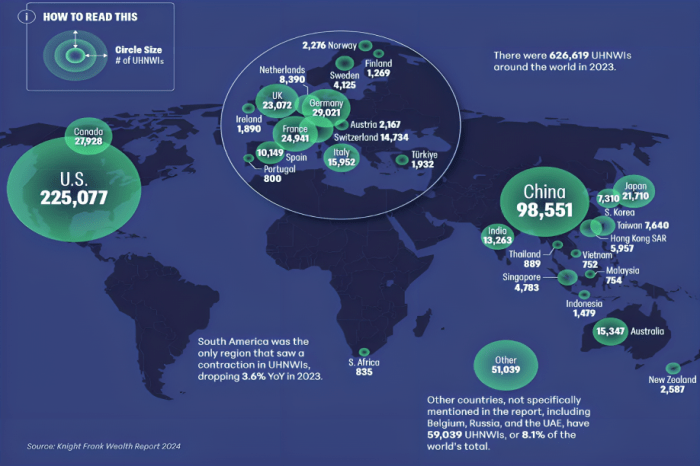

Ultra High Net Worth (UHNW) individuals are those with a net worth exceeding $30 million. Managing the wealth of UHNW clients requires specialized expertise due to the complex nature of their financial portfolios.

Significance of Specialized Wealth Management for UHNW Clients

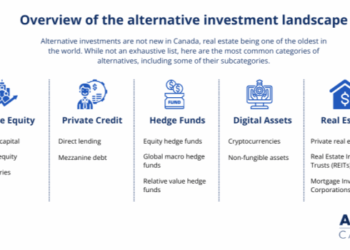

- UHNW individuals have diverse investment portfolios that include real estate, private equity, hedge funds, and other alternative investments. Proper management of these assets requires in-depth knowledge and experience.

- Tax planning is crucial for UHNW clients to minimize tax exposure and maximize wealth preservation. Wealth managers need to navigate intricate tax laws and regulations across multiple jurisdictions.

- Risk management is paramount for UHNW individuals due to the substantial assets at stake. Wealth managers must implement strategies to protect wealth against market volatility and unforeseen events.

Examples of How UHNW Individuals Differ from Other Wealth Segments

- UHNW individuals have access to exclusive investment opportunities, such as pre-IPO deals, that are not available to the general public.

- Their philanthropic endeavors involve significant sums of money and require strategic planning to maximize impact while optimizing tax benefits.

- Estate planning for UHNW clients involves complex structures like family offices and trusts to ensure seamless wealth transfer to future generations.

Strategies for Minimizing Tax Exposure Worldwide

When it comes to managing wealth for Ultra High Net Worth (UHNW) individuals, minimizing tax exposure is a top priority. There are several strategies that can be employed to achieve this goal, ranging from utilizing tax-efficient investment vehicles to taking advantage of international tax treaties.

Common Tax Minimization Strategies for UHNW Individuals

UHNW individuals often employ a variety of strategies to minimize their tax exposure. Some common approaches include:

- Utilizing tax-deferred investment accounts such as IRAs and 401(k)s

- Investing in tax-efficient assets like municipal bonds

- Establishing trusts to transfer assets and minimize estate taxes

- Taking advantage of charitable giving deductions

Comparison of Tax Regulations in Different Countries

Each country has its own tax laws and regulations that can impact how UHNW individuals manage their wealth. For example, some countries have lower income tax rates or more favorable treatment of capital gains. It's important for UHNW individuals to understand these differences and tailor their tax planning strategies accordingly.

Role of Offshore Accounts in Tax Planning

Offshore accounts can play a significant role in tax planning for UHNW individuals. By holding assets in jurisdictions with favorable tax laws, individuals can potentially reduce their tax burden

Key Considerations in Ultra High Net Worth Wealth Management

When it comes to managing ultra high net worth (UHNW) wealth, there are several key considerations that individuals need to keep in mind in order to navigate the complexities of their financial situation effectively.

Challenges UHNW Individuals Face in Managing Their Wealth

UHNW individuals face unique challenges when it comes to managing their wealth due to the sheer size and complexity of their assets. Some of the challenges include:

- The need for customized and specialized financial solutions to optimize returns

- Complex tax implications and compliance requirements across multiple jurisdictions

- Risk management strategies to protect wealth from market volatility

- Ensuring privacy and confidentiality in all financial dealings

Importance of Diversification in UHNW Portfolios

Diversification is crucial for UHNW portfolios as it helps spread risk across different asset classes, industries, and geographical regions. This strategy can help protect wealth from market downturns and volatility, ensuring a more stable and resilient portfolio over the long term.

Role of Professional Advisors in UHNW Wealth Management

Professional advisors play a critical role in UHNW wealth management by providing expert guidance and strategic advice tailored to the unique needs of high net worth individuals. These advisors help navigate complex financial landscapes, optimize tax efficiency, and implement sophisticated wealth preservation strategies to ensure the long-term growth and protection of wealth.

Closing Notes

As we conclude our exploration of how Ultra High Net Worth Wealth Management minimizes tax exposure worldwide, it becomes evident that strategic financial planning and expert guidance are essential in navigating the complex landscape of wealth management for high net worth individuals. The quest for tax efficiency is an ongoing journey that requires a delicate balance of knowledge and foresight.

Questions and Answers

What are some common tax minimization strategies for Ultra High Net Worth individuals?

Common strategies include utilizing trusts, gifting assets, investing in tax-efficient vehicles, and structuring income to minimize tax liabilities.

How do tax regulations differ across various countries for Ultra High Net Worth individuals?

Tax regulations vary widely, impacting factors like income tax rates, capital gains tax, inheritance tax, and the treatment of offshore accounts. It's crucial for UHNW individuals to stay informed on these variations.

What are the key challenges faced by Ultra High Net Worth individuals in managing their wealth?

Challenges include asset protection, succession planning, maintaining privacy, and complying with complex tax laws across different jurisdictions. Professional advice is crucial in navigating these obstacles.