As Ultra High Net Worth Wealth Management in the U.S. vs Europe: Key Differences takes center stage, this opening passage beckons readers with a captivating overview of the topic, setting the stage for a deep dive into the contrasting landscapes of wealth management in these two regions.

The subsequent paragraphs will delve into the regulatory environments, services offered, investment preferences and strategies, as well as wealth transfer and succession planning, shedding light on the intricate differences between UHNW wealth management practices in the U.S. and Europe.

Differences in Regulatory Environment

In the realm of Ultra High Net Worth (UHNW) wealth management, the regulatory frameworks in the United States and Europe play a crucial role in shaping the practices and strategies employed by wealth managers. These regulations not only impact how wealth is managed but also influence client decisions and investment strategies.

In the realm of Ultra High Net Worth (UHNW) wealth management, the regulatory frameworks in the United States and Europe play a crucial role in shaping the practices and strategies employed by wealth managers. These regulations not only impact how wealth is managed but also influence client decisions and investment strategies.Regulatory Framework in the U.S. vs Europe

In the United States, the regulatory environment for UHNW wealth management is primarily governed by agencies like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These entities oversee various aspects of wealth management, including investment advisory services and securities transactions. On the other hand, Europe has a more fragmented regulatory landscape with each country having its own set of rules and governing bodies, as well as overarching regulations from the European Union such as MiFID II and AIFMD.- The U.S. regulatory framework is known for its principles-based approach, allowing for more flexibility in compliance, whereas Europe tends to have a more rules-based approach with stricter guidelines and requirements.

- Key regulations in the U.S. like the Dodd-Frank Act and the Volcker Rule have significant implications for wealth management practices, particularly in the areas of risk management and proprietary trading.

- In Europe, regulations such as the Markets in Financial Instruments Directive (MiFID II) have introduced requirements for transparency, investor protection, and conflicts of interest management in wealth management activities.

Impact on Client Strategies and Investment Decisions

The differences in regulatory frameworks between the U.S. and Europe can influence how wealth managers structure client strategies and make investment decisions. For example, compliance requirements related to reporting, disclosure, and client suitability can vary significantly between the two regions, impacting the way wealth managers interact with clients and recommend investment products.- Wealth managers in the U.S. may have more leeway in designing customized investment solutions for clients due to the principles-based nature of regulations, whereas in Europe, the rules-based approach may limit the flexibility in tailoring strategies to individual client needs.

- Clients in the U.S. may have access to a wider range of investment products and services due to a more liberal regulatory environment, while clients in Europe may face more restrictions and disclosure requirements when engaging with wealth managers.

Compliance Challenges for Wealth Managers

Navigating the complex regulatory landscape in both the U.S. and Europe presents significant compliance challenges for wealth managers. Ensuring adherence to various regulations, staying up-to-date with changes, and managing regulatory risks are all critical aspects of operating in the UHNW wealth management space.- Wealth managers in the U.S. must contend with evolving regulatory requirements such as the SEC's Regulation Best Interest (Reg BI) and increased scrutiny on fee transparency and conflicts of interest, which can impact the way they interact with clients and structure investment recommendations.

- In Europe, wealth managers face challenges related to cross-border regulations, differing national laws, and compliance with EU directives, requiring a deep understanding of the regulatory environment in each jurisdiction where they operate.

Wealth Management Services Offered

In both the U.S. and Europe, Ultra High Net Worth (UHNW) individuals have access to a wide range of specialized wealth management services tailored to their unique financial needs and goals.Investment Management

In the U.S., investment management plays a significant role in wealth management services for UHNW individuals. Wealth managers focus on creating diversified investment portfolios, risk management, and maximizing returns. Tax-efficient strategies are also a key consideration in investment management.In Europe, investment management is also a crucial aspect of wealth management services for UHNW individuals. However, there is often a greater emphasis on sustainable and socially responsible investing. European wealth managers prioritize environmental, social, and governance (ESG) factors in their investment decisions.Tax Planning

Tax planning is a vital component of wealth management services for UHNW individuals in both the U.S. and Europe. Wealth managers help clients minimize tax liabilities through strategic planning, utilizing tax-efficient investment vehicles, and staying abreast of changing tax laws and regulations.Estate Planning

Estate planning is another essential service provided to UHNW individuals in both regions. Wealth managers assist clients in creating comprehensive estate plans to ensure the smooth transfer of wealth to future generations. This includes strategies to minimize estate taxes, establish trusts, and plan for charitable giving.Role of Family Offices and Private Banks

Family offices and private banks play a significant role in catering to UHNW clients in both the U.S. and Europe. Family offices offer personalized, holistic wealth management services, including investment management, tax planning, estate planning, philanthropic advising, and lifestyle management. Private banks provide specialized financial services, such as wealth advisory, investment management, lending, and succession planning.Customized Services and Solutions

There is a growing trend towards providing customized services and solutions for UHNW individuals in both the U.S. and Europe. Wealth managers are increasingly offering bespoke financial plans tailored to the specific needs and preferences of each client. This may include personalized investment strategies, tax planning solutions, estate planning structures, and specialized advisory services.Investment Preferences and Strategies

In understanding the differences between UHNW clients in the UU.S. Investment Preferences and Strategies

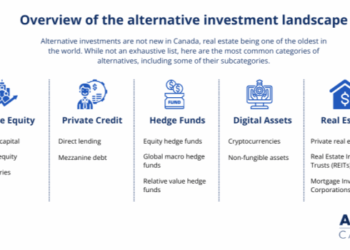

In the U.S., UHNW clients often exhibit a higher risk appetite compared to their European counterparts. They are more inclined towards aggressive investment strategies, seeking higher returns. This often leads to a greater allocation towards equities and alternative investments such as private equity and hedge funds. U.S. investors also value diversification but may focus more on domestic opportunities due to the size and diversity of the American market.European Investment Preferences and Strategies

Conversely, UHNW clients in Europe tend to have a more conservative risk appetite. They prioritize wealth preservation and steady growth over high-risk, high-reward investments. European investors commonly opt for traditional asset classes like bonds and real estate for stability. Diversification across regions and asset classes is crucial for European clients to mitigate risk and protect their wealth.Comparison of Alternative Investments

Both U.S. and European UHNW clients utilize alternative investments to enhance their portfolios. While U.S. clients may have a higher exposure to private equity and hedge funds, European clients often favor real estate investments for long-term growth and stability. The use of alternative investments is influenced by factors such as regulatory environment, market conditions, and personal preferences.Geopolitical Factors and Investment Decisions

Geopolitical factors play a significant role in shaping the investment decisions of UHNW clients in both regions. Uncertainty related to political events, trade agreements, and economic policies can impact asset allocation and risk management strategies. U.S. investors may be more influenced by domestic policies and global market trends, while European investors closely monitor regional developments and international relations that could affect their investments.Wealth Transfer and Succession Planning

When it comes to wealth transfer and succession planning, there are significant differences between the U.S. and Europe. In both regions, inheritance laws and tax regulations play a crucial role in shaping the strategies employed by ultra high net worth individuals.

Approaches to Wealth Transfer and Succession Planning

In the U.S., wealth transfer and succession planning often involve the use of trusts, wills, and other estate planning tools to minimize tax liabilities and ensure a smooth transfer of assets to the next generation. On the other hand, in Europe, the emphasis is often placed on preserving family wealth and maintaining control over assets through structures like family offices and foundations.

Impact of Inheritance Laws and Tax Regulations

In both regions, inheritance laws and tax regulations can have a significant impact on succession planning strategies. For example, the U.S. has a higher estate tax threshold compared to many European countries, which can influence the timing and structure of wealth transfers. Additionally, the differing treatment of trusts and other estate planning vehicles can also shape the approach taken by UHNW individuals.

Examples of Successful Wealth Transfer Strategies

- In the U.S., many UHNW individuals utilize grantor retained annuity trusts (GRATs) to transfer wealth to heirs while minimizing gift and estate taxes.

- In Europe, the establishment of family offices and foundations has been a successful strategy for preserving wealth across generations.

Importance of Philanthropy and Legacy Planning

For UHNW individuals, philanthropy and legacy planning are crucial components of wealth transfer and succession planning. By incorporating charitable giving into their estate plans, individuals can not only leave a lasting impact on society but also benefit from tax advantages. Legacy planning, on the other hand, allows individuals to define and preserve their values, ensuring that their wealth is used in accordance with their wishes even after they are gone.

Final Thoughts

In conclusion, the discussion on Ultra High Net Worth Wealth Management in the U.S. vs Europe: Key Differences offers a comprehensive look at the nuances that shape wealth management strategies for UHNW individuals in these distinct regions. Through exploring regulatory frameworks, service offerings, investment strategies, and succession planning, it becomes evident how tailored approaches are essential in navigating the complexities of managing substantial wealth across borders.

Helpful Answers

What are the key regulatory differences between UHNW wealth management in the U.S. and Europe?

Answer: The U.S. and Europe have distinct regulatory frameworks that impact wealth management practices, with variations in compliance requirements and oversight agencies.

How do family offices and private banks cater to UHNW clients in both regions?

Answer: Family offices and private banks play crucial roles in providing specialized services tailored to the needs of UHNW individuals, offering personalized solutions for wealth management.

What are the common investment preferences observed among UHNW clients in the U.S. and Europe?

Answer: UHNW clients in the U.S. and Europe exhibit diverse investment preferences, with varying appetites for risk, diversification strategies, and utilization of alternative investments.

How do inheritance laws and tax regulations influence succession planning strategies for UHNW individuals in both regions?

Answer: Inheritance laws and tax regulations have a significant impact on succession planning strategies, shaping decisions related to wealth transfer and legacy planning for UHNW clients.