Delving into the world of ultra high net worth advisors and their preference for alternative investments opens up a realm of unique opportunities and strategies. As they navigate through the financial landscape, these advisors are drawn to alternative investments for reasons beyond the conventional. Let's unravel the mysteries behind their focus on these non-traditional assets.

The content of the second paragraph that provides descriptive and clear information about the topic

Why Ultra High Net Worth Advisors Prefer Alternative Investments

Ultra high net worth advisors often choose alternative investments for their clients due to the unique characteristics and benefits these investments offer.

Characteristics of Alternative Investments

- Diversification: Alternative investments provide a way to diversify a high net worth portfolio beyond traditional stocks and bonds, reducing overall risk.

- Low Correlation: Many alternative investments have low correlation with the stock market, providing a hedge against market volatility.

- Potential for Higher Returns: Some alternative investments, such as private equity and real estate, have the potential to generate higher returns compared to traditional investments.

Examples of Commonly Favored Alternative Investments

- Private Equity: Ultra high net worth individuals often invest in private equity funds to access high-growth companies before they go public.

- Hedge Funds: Hedge funds offer sophisticated investment strategies and the potential for above-market returns, attracting high net worth investors.

- Real Estate: Real estate investments, including direct property ownership and real estate investment trusts (REITs), are favored for their income generation and long-term growth potential.

Benefits of Including Alternative Investments

- Enhanced Portfolio Performance: By adding alternative investments to a high net worth portfolio, advisors can potentially improve overall performance and risk-adjusted returns.

- Access to Unique Opportunities: Alternative investments provide access to unique opportunities not available through traditional investments, such as venture capital or commodity trading.

- Inflation Hedge: Some alternative investments, like commodities or infrastructure, can act as a hedge against inflation, preserving the real value of the portfolio.

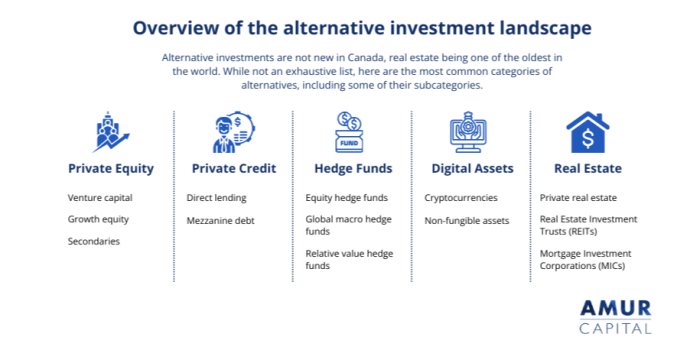

Types of Alternative Investments

Ultra high net worth advisors often focus on a variety of alternative investments to diversify their portfolios and potentially achieve higher returns.

Real Estate

Real estate is a popular alternative investment choice for ultra high net worth advisors due to its potential for long-term appreciation, passive income through rental properties, and a hedge against inflation.

Private Equity

Private equity investments involve investing directly in private companies or participating in buyouts, providing the opportunity for significant returns but also carrying higher risks compared to public equities.

Hedge Funds

Hedge funds are actively managed investment funds that can use a variety of strategies to generate returns, including long/short equity, global macro, and event-driven approaches. Ultra high net worth advisors may invest in hedge funds for the potential to outperform traditional investments.

Commodities

Investing in commodities such as gold, silver, oil, or agricultural products can provide diversification benefits and a hedge against inflation or economic uncertainties. Ultra high net worth advisors may allocate a portion of their portfolios to commodities for risk management.

Venture Capital

Venture capital investments involve funding early-stage companies with high growth potential, offering the possibility of substantial returns but also carrying significant risks. Ultra high net worth advisors may invest in venture capital funds to access innovative companies and potential unicorns.

Risk Management in Alternative Investments

Alternative investments can offer attractive returns but often come with higher risks compared to traditional investments. Ultra high net worth advisors play a crucial role in evaluating and managing these risks to protect their clients' wealth and optimize investment outcomes.Evaluating and Managing Risks

- Ultra high net worth advisors conduct thorough due diligence on alternative investments to assess the risks involved. This includes analyzing the investment structure, underlying assets, market conditions, and potential regulatory changes.

- Advisors also consider the liquidity risk associated with alternative investments, as they may have longer lock-up periods or limited exit options compared to traditional investments.

- They use sophisticated risk management tools and techniques to quantify and monitor risks, such as Value at Risk (VaR) models, stress testing, and scenario analysis.

Strategies to Mitigate Risks

- Diversification is a key strategy employed by advisors to reduce the concentration risk in alternative investments. By spreading investments across different asset classes, geographies, and strategies, they aim to minimize the impact of any single investment's underperformance.

- Utilizing hedging strategies, such as options, futures, and other derivatives, can help protect against downside risks and market volatility. These strategies can provide a level of insurance against adverse market movements.

- Advisors may also negotiate favorable terms with fund managers, such as enhanced transparency, better liquidity terms, and improved governance structures, to mitigate risks and align interests with investors.

Role in Hedging Against Market Volatility

- Alternative investments, such as real estate, commodities, and private equity, have shown to have low correlation with traditional asset classes like stocks and bonds. This low correlation can help diversify a portfolio and reduce overall volatility.

- During economic downturns or market turbulence, alternative investments can act as a hedge by providing stable returns or downside protection, thereby cushioning the impact of broader market declines.

- By incorporating alternative investments in their portfolios, ultra high net worth advisors aim to achieve a more balanced and resilient investment strategy that can weather market uncertainties and deliver sustainable long-term growth.

Performance and Returns of Alternative Investments

Alternative investments have gained popularity among ultra high net worth advisors due to their potential for higher returns compared to traditional asset classes. When assessing the success of alternative investments in their portfolios, advisors typically look at historical performance data and key performance indicators.

Historical Performance of Alternative Investments

Alternative investments, such as private equity, hedge funds, real estate, and commodities, have shown the potential to outperform traditional assets like stocks and bonds over the long term. Historical data indicates that alternative investments have provided attractive returns and helped diversify investment portfolios.

Measuring Success of Alternative Investments

Ultra high net worth advisors measure the success of alternative investments by analyzing their risk-adjusted returns, correlation with other assets, and overall impact on portfolio performance. They also consider factors such as liquidity, volatility, and potential for capital preservation.

Key Performance Indicators for Assessing Returns

- Annualized Returns: Advisors look at the average annual returns generated by alternative investments over a specific time period to assess their performance.

- Sharpe Ratio: This ratio measures the risk-adjusted return of an investment and helps advisors evaluate the efficiency of alternative investments in generating returns relative to the level of risk taken.

- Alpha and Beta: Alpha measures the excess return of an investment compared to a benchmark, while Beta indicates the volatility of the investment relative to the market. Advisors use these metrics to evaluate the performance and risk exposure of alternative investments.

Conclusive Thoughts

In conclusion, the allure of alternative investments for ultra high net worth advisors lies in their ability to enhance portfolio diversification, manage risks effectively, and potentially yield higher returns. By understanding the intricacies of these investment options, advisors can navigate the complex financial markets with confidence and innovation.

Helpful Answers

What are the main characteristics that attract ultra high net worth advisors to alternative investments?

Ultra high net worth advisors are drawn to alternative investments due to their potential for high returns, low correlation with traditional asset classes, and opportunities for portfolio diversification beyond stocks and bonds.

How do ultra high net worth advisors evaluate and manage risks associated with alternative investments?

Ultra high net worth advisors employ thorough due diligence processes, diversification strategies, and risk mitigation techniques to assess and manage the unique risks of alternative investments effectively.

What role do alternative investments play in hedging against market volatility and economic downturns?

Alternative investments can serve as a valuable hedge against market volatility and economic downturns by offering non-correlated returns and protection during turbulent times in traditional financial markets.